A Brave, New (Traditional) World

R.A. Hiller stays on the cutting edge, while maintaining old-school qualities

The goods and services and the means by which they’re made and distributed may have changed through the years, but the intangibles like reliability, dependability and quality have not.

And that, in the estimation of Ed Good, is what’s kept the R.A. Hiller Company in good stead with its customers and employees over 60-plus years since its humble beginnings in western Pennsylvania.

“It’s really like a family-first environment here,†said Good, an 18-year company veteran who’s now the sales manager for the Hiller’s nuclear division. “Everybody understands that you have to work to make money, but family is very important and that’s carried over. It’s the type of company that as long as you take care of what you’re responsible for and you do your job, it’s a very fair place to work.â€

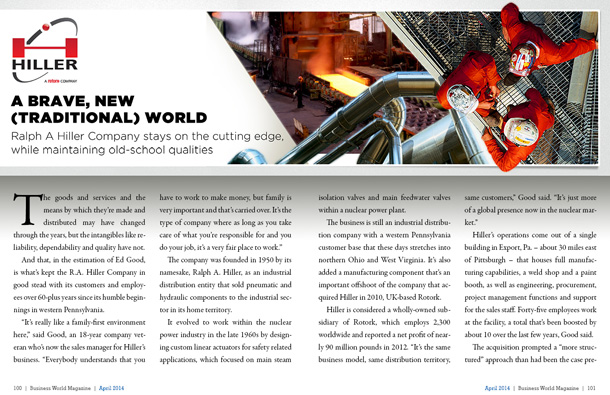

The company was founded in 1950 by its namesake, Ralph A. Hiller, as an industrial distribution entity that sold pneumatic and hydraulic components to the industrial sector in its home territory.

It evolved into work within the nuclear power industry in the late 1960s by designing custom linear actuators for safety related applications, which focused on main steam isolation valves and main water feed valves within a nuclear power plant.

The business is still an industrial distribution company with a western Pennsylvania customer base that these days also stretches into northern Ohio and West Virginia. It’s also added a manufacturing component that’s an important offshoot of the company that acquired Hiller in 2010, UK-based Rotork.

Hiller is considered a wholly-owned subsidiary of Rotork, which employs 2,300 worldwide and reported a net profit of nearly 90 million pounds in 2012. “It’s the same business model, same distribution territory, same customers,†Good said. “It’s just more of a global presence now in the nuclear market.â€

Hiller’s operations come out of a single building in Export, Pa. – about 30 miles east of Pittsburgh – that houses full manufacturing capabilities, a weld shop and a paint booth, as well as engineering, procurement, project management functions and support for the sales staff. Forty-five employees work out of the facility, a total that’s been boosted by about 10 over the last few years, Good said.

The acquisition prompted a “more structured†approach than had been the case previously, he said.

“We were run as a typical privately held mom and pop shop,†he said. “Now we follow more of a corporate structure where we have a management team in place. A general manager, then an executive management team, then supervisory roles and then the employees, the rank and file.â€

The affiliation with Rotork has kick-started an ambitious growth plan that is anticipated to take the company’s revenue from the “$20 million range†at which it sits now, Good said, to $40 million within five years. The would-be drivers of the growth are the nuclear market and product development.

Some new custom actuators are being worked on in development stages now and should be released within the next few years with significant revenue impact. And while the company still derives 60 percent of its overall revenue from its roots as a distribution enterprise, “the 40 percent (that comes from product manufacturing),†in Good estimation, “is becoming a lot more important.â€

“It’s a core focus of the business, for the simple fact that it’s a high-margin business,†he said.

Those products are being sold on the plant level at nuclear facilities across the United States, along with OEM (original equipment manufacturer) valve makers. Hiller works with those valve makers by providing the actuation for valves that ultimately go into plants.

As a distributor, Hiller represents certain parts manufacturers and has been given territorial rights to sell in its aforementioned western Pennsylvania, northern Ohio and West Virginia backyard.

Other distribution companies have traditionally handled territories elsewhere across the country, but Good conceded that the regionalized model has been changed significantly by online capability that allows interested parties to buy whatever they want from whomever they want.

Aside from its nuclear-related product manufacturing, Hiller also does value-added assembly for some customers, including pneumatic control panels for the mining industry and other small interests. Some assembly work is done on the nuclear side as well, but the bulk of work in that space is manufacturing.

“There’s not a lot of people that like to play in the nuclear world, because it’s a very paperwork-driven industry,†Good said. “There are a lot of quality programs that you have to adhere to.â€

The move from private ownership to Rotork oversight hasn’t come at the expense of corporate culture, which hasn’t changed significantly since the 2010 transition. The parent’s subsidiaries are largely run the way they were before the acquisitions, which, in Hiller’s case, is with a family-first mindset.

Some anticipated a drastic change and left when things changed hands, but the fears were unfounded.

“Everybody understands that you have to work to make money, but at the same time, family is very important to the Rotork group,†Good said. “That all carries forward from the way it was before they owned it, too.â€

Facility upgrades are being talked about within the management team, which would then need to present the ideas to the Rotork board to convince them of the potential return on investment. A testing area and quality area upgrade for the existing building is possible, and enough room exists on the current property to add new structures if circumstances warrant.

The in-house processes aren’t likely to undergo significant changes, Good said, because they’re so highly specified by oversight organizations like the Nuclear Regulatory Commission.

A drive to make products more user-friendly is a goal – making actuators lighter and changing some of their controls, for instance – but NRC standards for maintenance cycles, testing and standardization don’t leave a great deal of wiggle room for novelty.

The rigidity in some places, however, doesn’t impede the overall optimism for the future.

“I see a constant growth pattern,†Good said. “We struggled for the first couple years after being acquired by Rotork, but we got through those growing pains. The last two years have been growth each year and I see us, with some of the new potential products we’re coming up with, getting a bigger hold in the marketplace and I see our customers relying on us more for engineering capabilities.

“Five years from now, we’re comfortably approaching that $40 million yearly income range, we’ve done our expansion and we’re looking for more.â€

AT A GLANCE

WHO: R.A. Hiller Company

WHAT: Manufacturer/distributor for the fluid power, motion control and nuclear power industries

WHERE: Export, Pa.

WEBSITE: www.RAHiller.com